When it comes to financing home and business remodels, there are several options available to owners. Choosing the right finance option can make a significant difference in the overall cost and convenience of your home improvement project. Here are some popular finance options for home remodels:

- FHA 203(k) Loan: The FHA 203(k) loan program allows homeowners to finance the purchase or refinance of a home along with its renovation costs into one loan. This option can be ideal for those looking to purchase a fixer-upper or renovate their current home.

- NACA Program: The NACA program, or Neighborhood Assistance Corporation of America, offers a unique home renovation loan with no down payment, closing costs, or fees. This program is designed to help low-to-moderate income homeowners achieve their home improvement goals.

- Home Equity Line of Credit (HELOC): A HELOC allows homeowners to borrow against the equity in their home to fund renovation projects. This revolving line of credit can be a flexible and convenient option for those with significant equity in their homes.

- SBA Loan for Business Renovations: The Small Business Administration (SBA) offers loan programs specifically designed for business renovations. These loans may provide competitive interest rates and favorable terms for eligible businesses looking to undertake renovation projects.

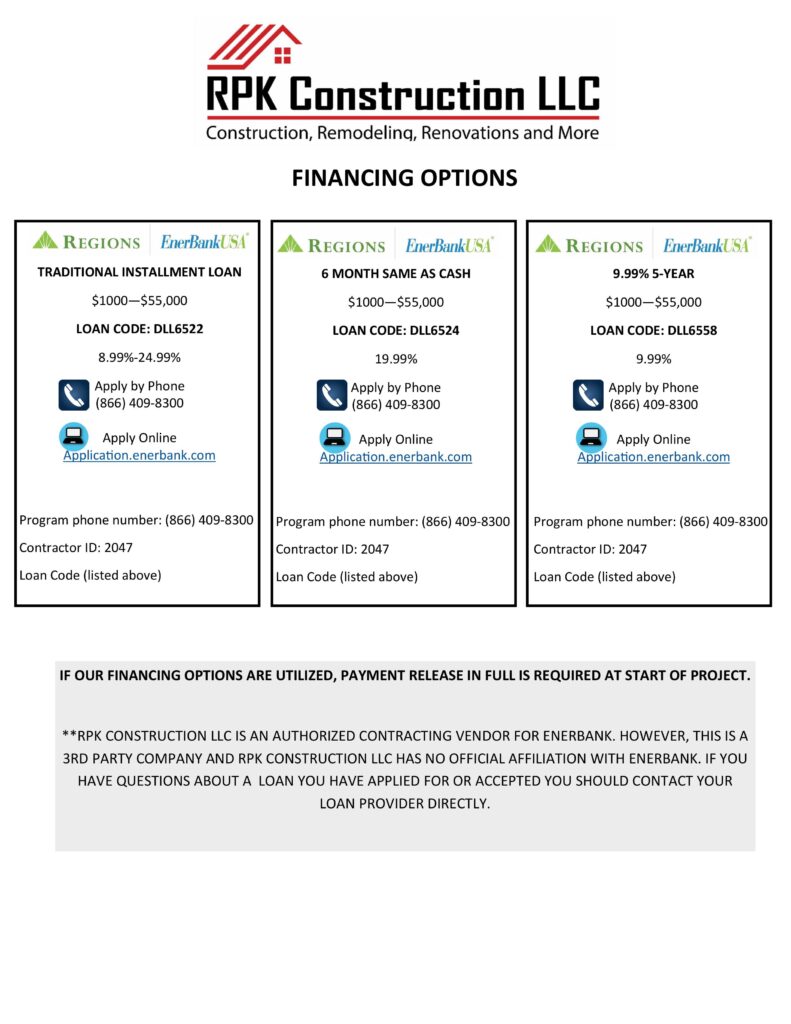

- EnerBank USA: EnerBank USA are alternative options for homeowners looking to finance their home remodels. EnerBank USA offers competitive loan programs with favorable terms and requirements, making it a popular choice for many homeowners seeking financing for their projects. RPK Construction offers solutions from EnerBank. Click the link to learn more.

By exploring these finance options, homeowners can find the right solution to fund their home remodeling projects and achieve their desired improvements. If you’re considering financing your home remodel, RPK Construction can work with loan providers to help you explore suitable options. Visit our finance page to learn more about the financing options available to you and then click the link at the top of our home page to apply.

Recent Comments